Scenario

Services of Electronic Bill Payment and Presentment (EBPP) have transformed. Multichannel payment management is a prerequisite for increasing customer satisfaction and loyalty by reducing the collection costs.

It is critical that the whole process is easy and intuitive, providing contextual billing information that goes beyond the amount due, along with a timely and informed prompt notification service.

These solutions offer new ways to reach users. What was a back-end transaction turns into a real discriminating choice of a Utility that offers solutions for:

Scheduling recurring payments or one-time payments

Managing your own registration and payment methods via wallet

Viewing payment history or receiving notifications

The evolution of EBPP services aims to eliminate data fragmentation through a single integrated platform which streamlines the management of invoices and payment processes, offering a seamless user experience.

Solution

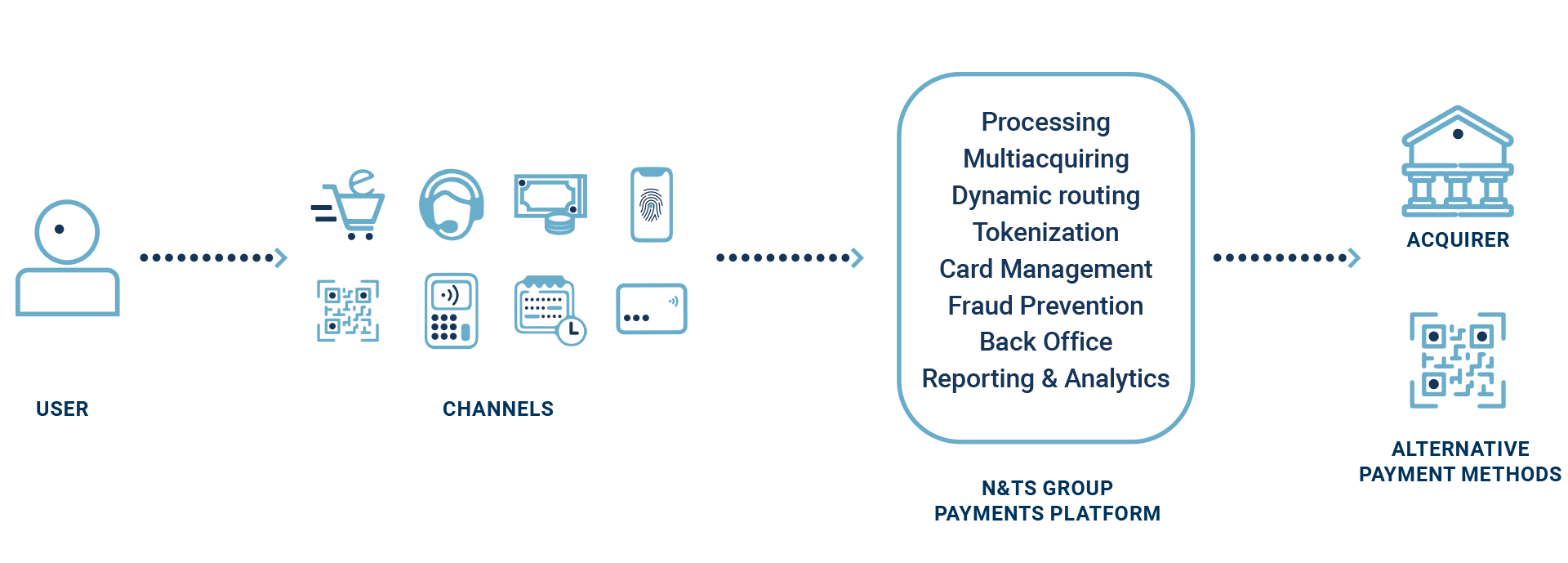

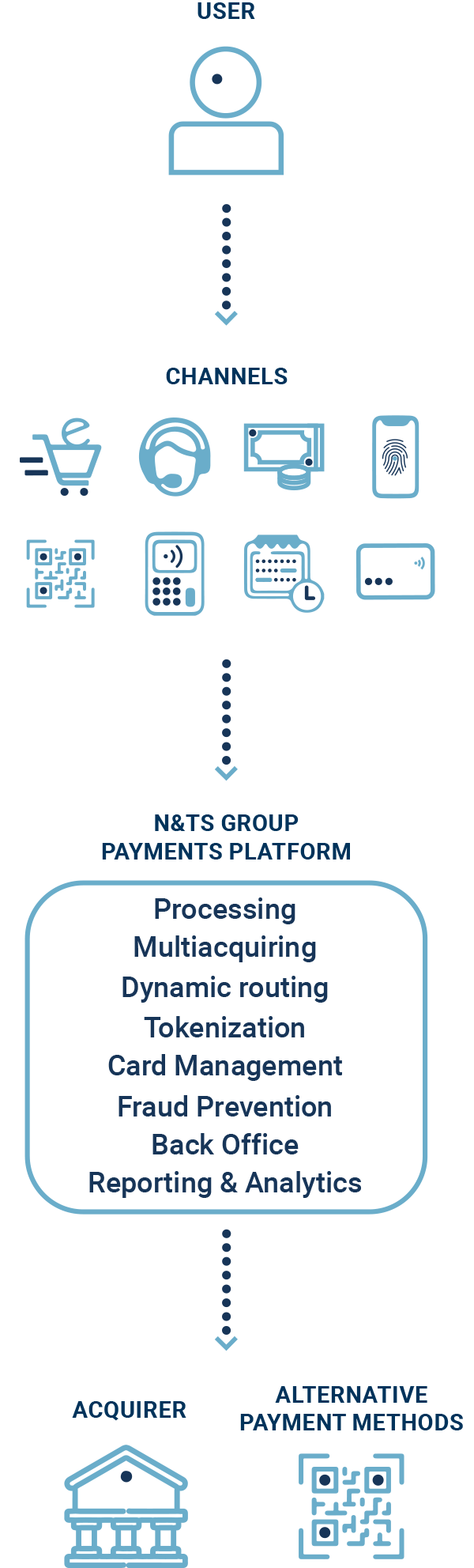

The N&TS GROUP solution streamlines the process of paying bills, even and especially when clients have a habit of using different channels simultaneously. What we offer is a service which makes it possible to manage them from a single hub, simplifying treasury operations and providing a comprehensive and consolidated view of all transactions from all channels.

Online

Online

Make the most innovative payment methods available to deliver a frictionless payment experience worldwide.

Recurring payments

Recurring payments

Gives customers flexibility in managing recurring payments with integrated card alignment features.

Omnichannel

Omnichannel

Deliver a simple and secure payment experience regardless of method, channel, or location, and consolidate all transaction data into one platform.

Fraud Prevention

Fraud Prevention

Reduce the risk of fraud and charge back with a highly customizable and innovative real-time fraud prevention solution with Machine Learning and AI.

Advantages

Simple and global payment gateway

Rapid expansion of online and mobile channels.

Superior payment experience

Real-time customer need satisfaction regardless of channel.

Innovation and time to market improvement

Accelerate innovations and reduce time to market to meet and exceed company expectations.

Flexibility, scalability, and modularity

Flexibility and agile integration through open APIs, robust product logic, scalability, and modularity in response to the needs of the sector.

Full control of the payment solution

Independence in financial relations and customer loyalty initiatives.

Security

Full compliance with standards security and GDPR for data protection throughout the payment process.

Supplementary services

- Multi-acquiring and dynamic routing

The solution which makes it possible to define the routing of each individual transaction to the best acquirer, reducing commissions, increasing conversions, and ensuring fallback in case of unavailability of a financial partner. Different routing criteria are available, applicable in real time: card bin, payment instruments, membership schemes, geographical parameters, terminal ranges, amounts, and other statistical criteria. - Private and scheme tokenization

It is the solution which reduces fraud and data breach risk by replacing card numbers with a digital token, simplifying the payment user experience and increasing the conversion rate. - Wallet

It is the fast and effective payment securities registration tool, which makes the management of one click payments, preferred methods and fallback strategies possible. - Commission calculation

The backoffice solution which makes it possible to predict the amount of fees, check the acquirer calculations, and evaluate set routing rules. - Fraud prevention

The advanced real time fraud prevention solution is customizable based on customer needs, thanks to Machine Learning and AI. - Reporting & Analytics

Reporting to analyse statistics, profile customers, and monitor performance, KPI, and user experience. A useful tool for companies, to refine applied solutions, improve the quality of services offered, and determine what factors affect market trends.

Solution overview

Security and certifications

There is no innovation without security. N&TS GROUP has chosen to guarantee it at 360 degrees.

Data protection for clients and their users is at the heart of N&TS GROUP’s research and development systems. With this in mind, the certifications obtained in various fields are the most important guarantee of reliability, safety and compliance with global standards. This constant commitment has allowed N&TS GROUP to become protagonists in the digital revolution and to emerge in the markets of reference.

PCI DSS

PCI DSS

It is the international standard established by the PCI Security Standards Council for the protection of card holders' payment data and/or sensitive authentication data through the adoption of security measures to protect card payment transactions.

PCI PA DSS

PCI PA DSS

It is the international standard defined by the PCI Security Standards Council for software providers developing payment applications.

PCI P2PE

PCI P2PE

It is the international standard established by the PCI Security Standards Council to validate in their entirety (hardware, software, gateway, decryption, device management,) electronic payment solutions, ensuring that sensitive and confidential data are sufficiently protected in all components of the system.

AGID

AGID

It is the certification for public administration cloud services and ensures that infrastructures are developed and provided according to minimum reliability and security criteria considered necessary for public digital services.

ISO 9001

ISO 9001

Quality management system in the field of design, development, maintenance, electronic payment and collection applications assistance and provision of related services in SaaS or Hosting mode.

ISO 22301

ISO 22301

It is the certification for public administration cloud services and ensures that infrastructures are developed and provided according to minimum reliability and security criteria considered necessary for public digital services.

ISO 27001

ISO 27017

ISO 27017

ISO 27001 is the code of conduct for information security checks for the provisioning of cloud services.

ISO 27018

ISO 27018

ISO 27018 is the code of conduct for the protection of Personally Identifiable Information (PII) for cloud provider services.

PCI 3DS CORE

PCI 3DS CORE

It is a Security Standard by PCI SSC, supporting the functionality of EMVCo's EMV 3D Secure core security protocol.

VISA PIN

VISA PIN

The PCI PIN Security standard includes a comprehensive set of requirements for the secure management, processing and transmission of personal identification number (PIN) data and data relating to unattended POS terminals.

Request a presentation

If you’d like more information, don’t hesitate to contact us. It will be our pleasure to offer you the best solution tailored to your needs.