Scenario

The global market requires efficient management of systems that are capable of providing modular and scalable services tailored to specific sectors. A comprehensive platform of e-money services is the key to managing complex information from a unified perspective.

Security is an industry imperative: regulation, certification and compliance are the basis of payment solutions that increase consumer confidence and ensure operational excellence.

Riding the digital transformation wave in real time is the biggest challenge for financial institutions, who must commit to:

Being flexible to meet market demands

Reducing launch time of new services

Converging payment channels and methods

Optimizing payment service costs

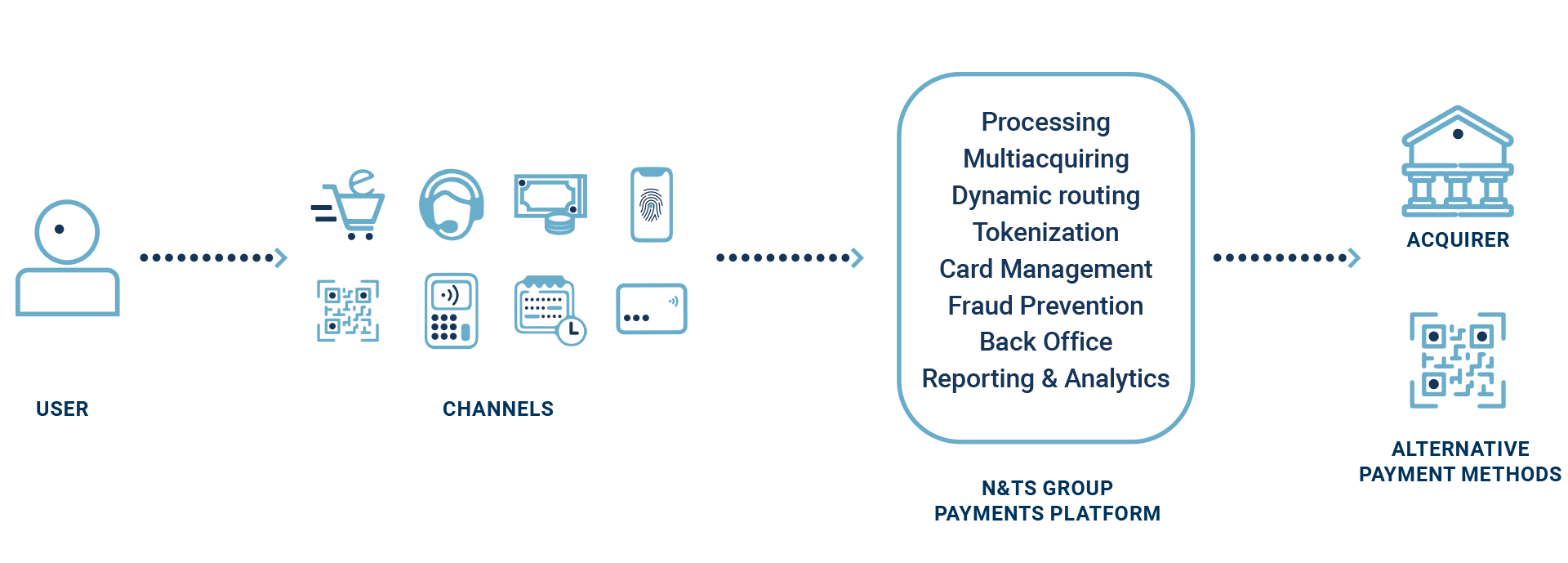

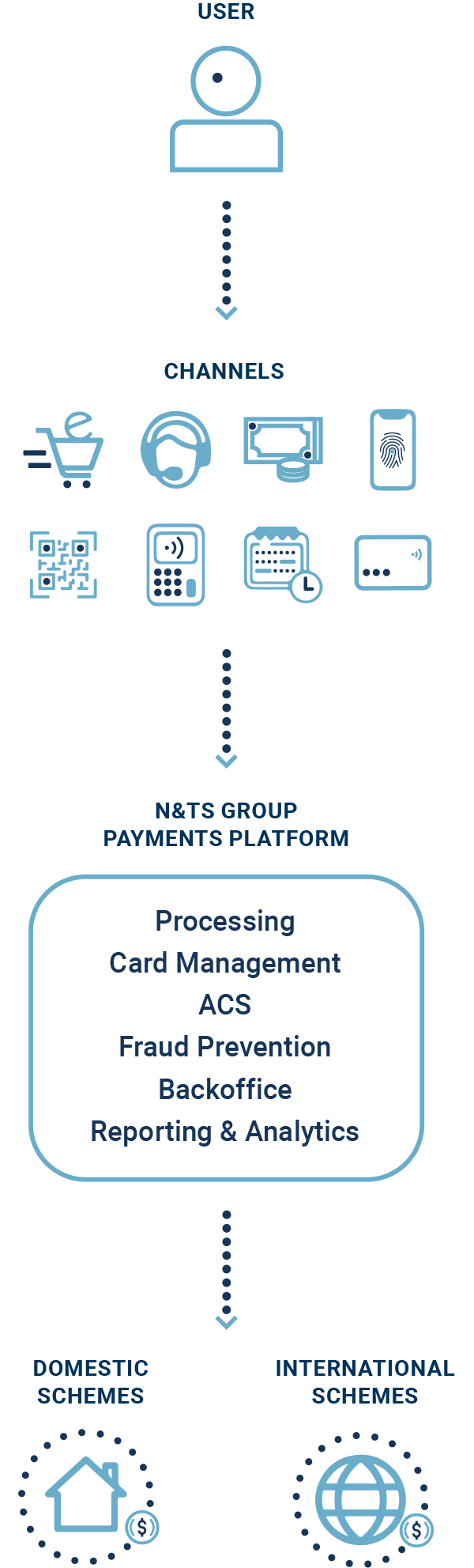

N&TS GROUP solutions are designed to provide Issuing, Acquiring, Authorization, Backoffice and Fraud Prevention capabilities which can be integrated into the Finance ecosystem, with guided, fast, and targeted migrations.

Solution

N&TS GROUP offers a complete suite of modular and flexible payment solutions which allows users to anticipate and respond to the diverse needs of the financial institutions world.

Card management

Card management

Offer a complete debit, credit, and prepaid card management solution with issuing, acquiring, authorization and Backoffice features

ACS

ACS

Manage 3-D Secure processes and authenticate cardholders during online payments with an EMV.CO and PCI-3DS certified solution

Fraud Prevention

Fraud Prevention

Reduce the risk of fraud and charge back with a highly customizable and innovative real-time fraud prevention solution with Machine Learning and AI

Omnichannel

Omnichannel

Deliver a simple and secure payment experience regardless of method, channel, or location, and consolidate all transaction data into one platform

Advantages

Operational excellence

Reduce the complexity of legacy infrastructure and ensure operational excellence, while meeting increasingly complex regulatory requirements.

Flexibility, scalability, and modularity

Flexibility and agile integration through open APIs, robust product logic, scalability, and modularity in response to the needs of the finance world.

Innovation and time to market improvement

Accelerate innovations and reduce time to market to meet and exceed customer expectations.

Full control of the payment solution

Ability to improve cross selling and up selling thanks to consolidated business data analysis from the different payment services offered.

Deliver a superior payment experience

Real-time customer satisfaction regardless of channel.

Security

Full compliance with security standards and GDPR for data protection throughout the payment process.

Supplementary services

- Backoffice

The complete backoffice solution, which offers both merchant and terminal census, including RAC census for Pagobancomat, compliance requests towards acquirers, as well as the KYC function.

Commission calculation

A feature that makes it possible to predict the commissions total, check the acquirer calculations and evaluate set routing rules.

Asset Management POS

A service dedicated to the management of all POS terminals on the market, which is a focal point ensuring targeted supervision and interventions on the entire chain of in-store payment.

Reporting & Analytics

Availability of reports to analyse statistics, profile customers, and monitor performance, KPIs, and user experience. A useful tool for companies, to refine applied solutions, improve the quality of services offered and determine what factors affect market trends.

Overview solution

Security and certifications

There is no innovation without security. N&TS GROUP has chosen to guarantee it at 360 degrees.

Data protection for clients and their users is at the heart of N&TS GROUP’s research and development systems. With this in mind, the certifications obtained in various fields are the most important guarantee of reliability, safety and compliance with global standards. This constant commitment has allowed N&TS GROUP to become protagonists in the digital revolution and to emerge in the markets of reference.

PCI DSS

PCI DSS

It is the international standard established by the PCI Security Standards Council for the protection of card holders' payment data and/or sensitive authentication data through the adoption of security measures to protect card payment transactions.

PCI PA DSS

PCI PA DSS

It is the international standard defined by the PCI Security Standards Council for software providers developing payment applications.

PCI P2PE

PCI P2PE

It is the international standard established by the PCI Security Standards Council to validate in their entirety (hardware, software, gateway, decryption, device management,) electronic payment solutions, ensuring that sensitive and confidential data are sufficiently protected in all components of the system.

AGID

AGID

It is the certification for public administration cloud services and ensures that infrastructures are developed and provided according to minimum reliability and security criteria considered necessary for public digital services.

ISO 9001

ISO 9001

Quality management system in the field of design, development, maintenance, electronic payment and collection applications assistance and provision of related services in SaaS or Hosting mode.

ISO 22301

ISO 22301

It is the certification for public administration cloud services and ensures that infrastructures are developed and provided according to minimum reliability and security criteria considered necessary for public digital services.

ISO 27001

ISO 27017

ISO 27017

ISO 27001 is the code of conduct for information security checks for the provisioning of cloud services.

ISO 27018

ISO 27018

ISO 27018 is the code of conduct for the protection of Personally Identifiable Information (PII) for cloud provider services.

PCI 3DS CORE

PCI 3DS CORE

It is a Security Standard by PCI SSC, supporting the functionality of EMVCo's EMV 3D Secure core security protocol.

VISA PIN

VISA PIN

The PCI PIN Security standard includes a comprehensive set of requirements for the secure management, processing and transmission of personal identification number (PIN) data and data relating to unattended POS terminals.

Request a presentation

If you’d like more information, don’t hesitate to contact us. It will be our pleasure to offer you the best solution tailored to your needs.