Scenario

The vertical specificity of the Petrol sector involves different players and challenges for the construction of a user experience designed for the end consumer which is becoming increasingly wide and heterogeneous: the station becomes the place where to offer new services, in multiple areas, with different payment needs.

For Fuel retailers, the need for easy to release and manage solutions is growing, allowing for transactions to be easily monitored from all service stations, optimizing financial conditions thanks to overall volumes.

Knowing how to anticipate and respond to these challenges is the key utilised by industry players to attract new customers and retain them thanks to the ability to:

Offer a global solution that can handle local peculiarities.

Improve user experience with dedicated payment methods and channels such as kiosks, petrol pumps, mobile, and app payments.

Use of the collected data as a marketing tool to develop targeted campaigns based on buying habits.

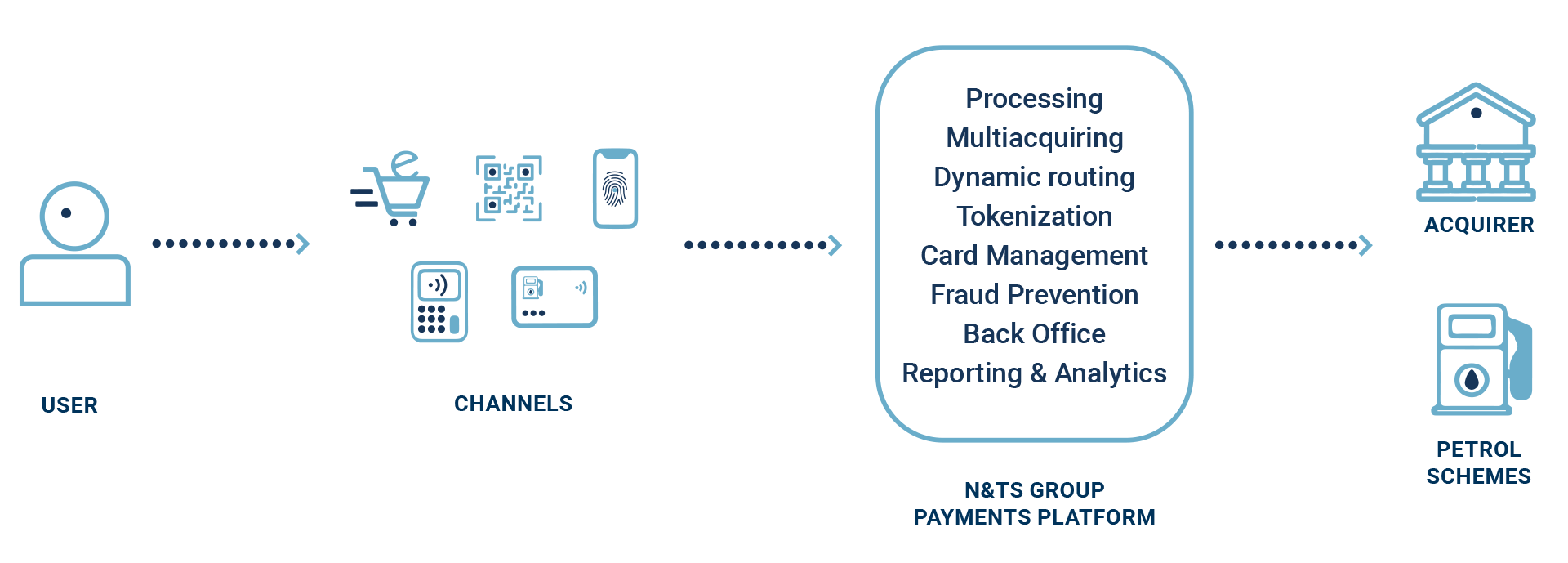

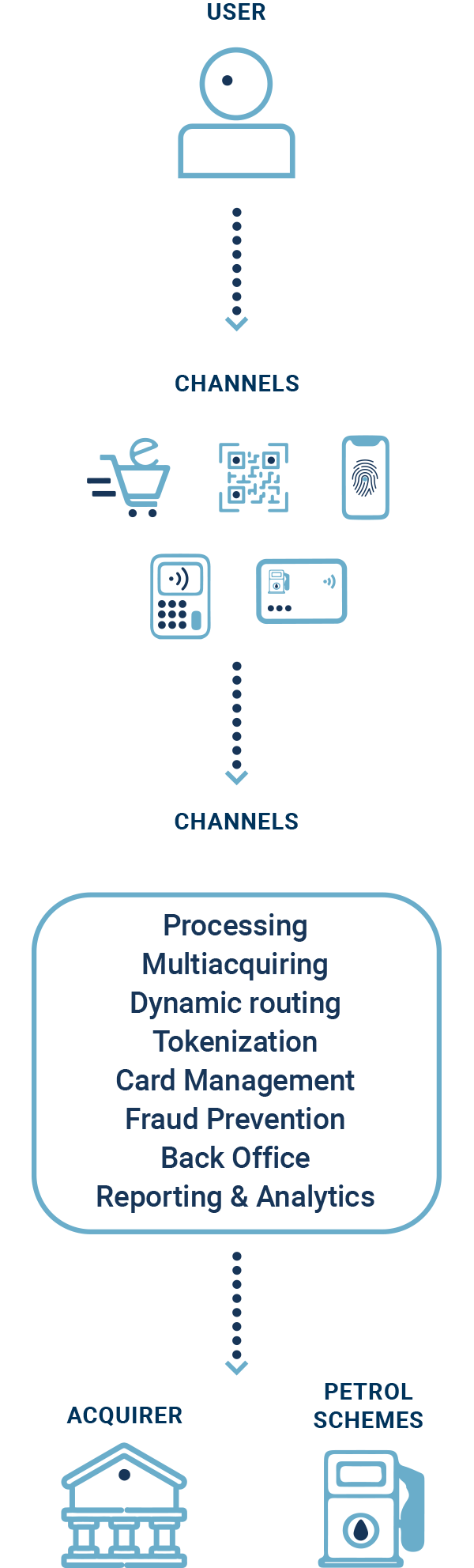

N&TS GROUP helps industry companies meet these challenges with a complete payment solution which can be easily integrated into the Petrol ecosystem, simplifying complexity and minimising release time.

Solution

Our solutions create an easy, fast, and adaptable payment experience for the most diverse needs: payments at the gas station, in–store purchases or electric car charging.

In Store

Online

Online

Provide the most innovative payment methods to deliver a frictionless payment experience worldwide.

Omnichannel

Omnichannel

Deliver a simple and secure payment experience regardless of method, channel, or location, and consolidate all transaction data into one platform.

Card management

Card management

Build your own privative payment circuit in compliance with international standards.

Advantages

Simple and global payment gateway

Rapid expansion of online and mobile channels.

Superior payment experience

Real-time customer need satisfaction regardless of channel.

Innovation and time to market improvement

Accelerate innovations and reduce time to market to meet and exceed company expectations.

Flexibility, scalability, and modularity

Flexibility and agile integration through open APIs, robust product logic, scalability, and modularity in response to the needs of the sector.

Full control of the payment solution

Independence in financial relations and customer loyalty initiatives.

Security

Full compliance with standards security and GDPR for data protection throughout the payment process.

Supplementary services

- Multi-acquiring and dynamic routing

The solution which makes it possible to define the routing of each individual transaction to the best acquirer, reducing commissions, increasing conversions, and ensuring fallback in case of unavailability of a financial partner. Different routing criteria are available, applicable in real time: card bin, payment instruments, membership schemes, geographical parameters, terminal ranges, amounts, and other statistical criteria. - Commission calculation

The backoffice solution which makes it possible to predict the amount of fees, check the acquirer calculations, and evaluate set routing rules. - POS Asset Management

The service dedicated to the management of all POS terminals on the market, which act as a focal point to ensure targeted supervision and interventions on the entire chain of in-store payments. - Fraud prevention

The advanced real time fraud prevention solution is customizable based on customer needs, thanks to Machine Learning and AI. - Reporting & Analytics

Reporting to analyse statistics, profile customers, and monitor performance, KPI, and user experience. A useful tool for companies, to refine applied solutions, improve the quality of services offered, and determine what factors affect market trends.

Solution overview

Security and certifications

There is no innovation without security. N&TS GROUP has chosen to guarantee it at 360 degrees.

Data protection for clients and their users is at the heart of N&TS GROUP’s research and development systems. With this in mind, the certifications obtained in various fields are the most important guarantee of reliability, safety and compliance with global standards. This constant commitment has allowed N&TS GROUP to become protagonists in the digital revolution and to emerge in the markets of reference.

PCI DSS

PCI DSS

It is the international standard established by the PCI Security Standards Council for the protection of card holders' payment data and/or sensitive authentication data through the adoption of security measures to protect card payment transactions.

PCI PA DSS

PCI PA DSS

It is the international standard defined by the PCI Security Standards Council for software providers developing payment applications.

PCI P2PE

PCI P2PE

It is the international standard established by the PCI Security Standards Council to validate in their entirety (hardware, software, gateway, decryption, device management,) electronic payment solutions, ensuring that sensitive and confidential data are sufficiently protected in all components of the system.

AGID

AGID

It is the certification for public administration cloud services and ensures that infrastructures are developed and provided according to minimum reliability and security criteria considered necessary for public digital services.

ISO 9001

ISO 9001

Quality management system in the field of design, development, maintenance, electronic payment and collection applications assistance and provision of related services in SaaS or Hosting mode.

ISO 22301

ISO 22301

It is the certification for public administration cloud services and ensures that infrastructures are developed and provided according to minimum reliability and security criteria considered necessary for public digital services.

ISO 27001

ISO 27017

ISO 27017

ISO 27001 is the code of conduct for information security checks for the provisioning of cloud services.

ISO 27018

ISO 27018

ISO 27018 is the code of conduct for the protection of Personally Identifiable Information (PII) for cloud provider services.

PCI 3DS CORE

PCI 3DS CORE

It is a Security Standard by PCI SSC, supporting the functionality of EMVCo's EMV 3D Secure core security protocol.

VISA PIN

VISA PIN

The PCI PIN Security standard includes a comprehensive set of requirements for the secure management, processing and transmission of personal identification number (PIN) data and data relating to unattended POS terminals.

Request a presentation

If you’d like more information, don’t hesitate to contact us. It will be our pleasure to offer you the best solution tailored to your needs.